Abstract

Low-carbon energy technology (LCET) startups could play a key role in accelerating India’s decarbonization. Yet, our understanding of the LCET startup landscape and what shapes it remains low. Here we provide an analysis of the Indian LCET startup landscape to fill this gap. Our descriptive analysis of quantitative data on investment and patenting activities of LCET startups from 2010 to 2020 and qualitative data from 25 semi-structured interviews shows a substantial increase in investment and patenting activity, particularly after 2017, driven in large part by market-creation measures undertaken by the Indian government. However, there are large differences between LCET startups in different sub-sectors and core value-creating activities. Our findings suggest that the level of technological capabilities moderates the relationship between market-creation measures and innovation outcomes—thus highlighting the need to complement market-creation policies with long-term measures to strengthen technological capabilities. Furthermore, we propose a research agenda to improve our understanding of LCET entrepreneurship in developing economies.

Similar content being viewed by others

Main

The invention, development and diffusion of low-carbon energy technologies (LCETs) is a key lever for meeting global climate targets1,2. Although several technologies such as solar photovoltaic (PV) and wind power are already mature and being deployed at scale3, recent estimates suggest that almost half of the emissions reductions required to reach net-zero emissions by 2050 will need to come from technologies that are currently at the demonstration or prototype stage4. Thus, many more innovative technologies and deployment models will need to be developed in the near future to decarbonize the economy.

Startups—defined in this paper as private companies that have been in operation for eight years or less5—are particularly promising in terms of the role they can play in developing, commercializing and deploying LCETs6. Certain characteristics of startups, such as their lack of deference to the status quo, agility, culture of experimentation and risk-taking ability, make them particularly suited for operating in a business environment characterized by emerging technologies and markets7,8. Entrepreneurship in LCETs is also increasingly being seen by national governments and international organizations as a means for combining climate change mitigation measures with economic growth, employment generation and industrial competitiveness9. Accordingly, over the past two decades, there has been a steadily increasing number of startups, investment transactions and investment volumes in the LCET space10.

In parallel, there has also been an increase in studies focusing on LCET startups, analysing aspects such as innovation6, partnerships with government agencies and universities11,12,13, investors’ preferences14,15 and risk-mitigation strategies16,17, to name a few. Many studies have investigated trends in innovation and investments in LCET startups. For example, Gaddy et al.18 compared trends in risk and return in LCET sub-sectors with medical and software startups, finding that LCET startups posed comparatively higher risks and yielded lower returns. Similarly, Bumpus and Comello19 highlighted a trend among early-stage investors towards increasing investments in technologies focused on software applications and demand-side solutions because of their lower capital intensity. In contrast, Popp et al.20 examined trends in venture capital investments in energy startups, finding that energy startups do not perform better or worse than the average startup and that there is increasing investor interest in energy startups that also operate in the high-tech space. Building on these findings, van den Heuvel and Popp21 noted that LCET startups are not inherently unattractive (because of capital intensity and long development cycles) but have often lacked market demand, leading to poor outcomes.

Such studies have primarily focused on industrialized countries, and in particular, on the United States. This is despite the fact that startup ecosystems in emerging economies such as India have exhibited substantial growth in recent years. For example, annual equity investments in Indian startups grew from US$7.8 billion in 2010 to US$60 billion in 2020 (Supplementary Fig. 1). Given that India now is the third-largest greenhouse gas emitter22 and one of the largest destinations for equity investments into startups23,24, both decarbonization and entrepreneurship have risen to the top of the political agenda as levers to attain India’s climate mitigation goals25. For example, India has set ambitious policy targets of deploying 450 GW of renewables26 and ensuring that 30% of all personal vehicle sales should be electric vehicles by 203027 through several market-creation policies, including the National Solar Mission28 launched in 2010 and the Faster Adoption and Manufacturing of Hybrid and Electric vehicle (FAME) scheme29 announced in 2015 (Supplementary Table 5). Similarly, the Startup India programme launched in 2016 aims to enhance ease of doing business, provide financial support, improve linkages with academia and facilitate intellectual property protection for startups.

Despite India’s important role in reducing greenhouse gas emissions, innovating in30 and deploying LCETs and as a destination for investments into LCET startups, our understanding of the nature of LCET startup activities in India remains low. The few studies focusing on India mainly have analysed social enterprises in the energy sector, which aim to extend access to modern energy sources, create employment and alleviate poverty31,32,33. These enterprises comprise only a small subset of LCET startups.

To address this gap, we answer the following research question: how have investments into and patenting by LCET startups in India evolved across different sub-sectors and value-creating activities, and which components of the entrepreneurship ecosystem are associated with these changes? To this end, we compiled a database of 318 LCET startups active in India from 2010 to 2020. We characterized the LCET startups in terms of their sub-sector and core value-creating activity. We also collected data on their fundraising (671 investment transactions and US$14.6 billion investment volume) and patenting activities (277 patent applications and 48 granted patents). We complemented this analysis with 25 expert interviews to better understand the components of the entrepreneurship ecosystem that are associated with the observed trends. On the basis of our analysis, we derive implications for policymakers and propose a research agenda to further improve our understanding of LCET entrepreneurship in developing and emerging economies.

Characterizing Indian LCET startups and their activities

For LCET startups, outcomes can vary depending on their sub-sector and core value-creating activity. For example, studies such as Gaddy et al.18, Bumpus and Comello19 and van den Heuvel and Popp21 classify LCET startups based on the type of innovation the company was commercializing (for example, hardware versus software solutions). On the other hand, studies such as Doblinger et al.11 and Goldstein et al.12 recognize that patenting and fundraising activities can also vary depending on the sub-sector in which the LCET startup is operating. To account for this diversity, we use a composite framework for classifying LCET startups along two dimensions (Table 1).

The sub-sector refers to the LCET startup’s position in the energy value chain and whether the technology is used to generate, transmit, store, distribute or use energy. For energy generation technologies, the end product is often a commodity (for example, electricity, drop-in fuels). Hence, in the absence of a differentiator such as a carbon tax or price premium for low-carbon energy, such early-stage startups struggle to compete with incumbents using conventional energy sources purely on price34. In contrast, startups that provide end-consumer products (for example, electric vehicles, energy efficient appliances) can often differentiate themselves from conventional technologies based on other characteristics (for example, better performance, greater ease of use, lower emission of local air pollutants, increased reliability)19,35. Finally, startups that provide low-carbon energy services (for example, off-grid irrigation or cold storage) often employ a combination of technologies for energy generation, management and use. Thus, we distinguish between five sub-sectors: renewable energy sources (RESs), grid management, mobility, energy efficiency and management and renewable energy-enabled solutions. Note that although ‘mobility’ and ‘energy efficiency and management’ are both related to end-use of energy, we take an approach similar to that of van den Heuvel and Popp21 in treating them separately, allowing us to differentiate between the investment and patenting trends in the two sub-sectors. This is especially important given that the mobility sub-sector is receiving growing attention from investors in recent years (‘Investment and patenting trends by sub-sector’ section).

The core value-creating activity refers to the primary business activity of the LCET startup18—whether it is involved in manufacturing, deployment or software development. This characteristic influences the LCET startup’s capital intensity, length of product development cycle, technological uncertainty and thus investment risks18,36. For example, material- and chemical-based manufacturing typically exhibits strong economies of scale and high process complexity37. This increases technological uncertainty, poses barriers to entry and creates a strong first-mover advantage34,38. In comparison, hardware integration involves the design, manufacturing or assembly of products, where the science and engineering behind each of the component technologies is relatively well established, thus resulting in relatively lower technology risks than material and chemical manufacturing. Note that although ‘hardware integration’ and ‘material and chemical manufacturing’ both represent manufacturing activities, we follow Gaddy et al.18 to distinguish between them because of their differences in technology risk, capital intensity and length of development cycle. In contrast, startups focusing on LCET deployment typically deal with commercialized technologies such as solar PV, wind power and, more recently, electric vehicles—an activity with high capital intensity but lower technology risk. Finally, business models that involve the development and use of software to help monitor, operate and optimize energy production and consumption have low capital intensity and shorter product development cycles, thus improving scalability, lowering technology risk and lowering barriers to entry19,36. Thus, we distinguish between four core value-creating activities: deployment, hardware integration, material and chemical manufacturing and software solutions.

For each of these categories, we collected and analysed data related to the LCET startups’ fundraising and patenting activities in three steps (Methods). First, we collected data related to equity investment deals into LCET startups and classified them as Early, Late and Mature stage10,15. The early stage comprises pre-seed, seed, series A and series B rounds, which span the ideation, prototyping and demonstration phase in the growth of a startup. Venture capital investment rounds from series C onwards comprise the late stage, during which startups focus on commercialization and early growth. The mature stage covers private equity (PE) investments, exit events (such as mergers and acquisitions (M&As) or initial public offerings (IPOs)) and post-exit equity investments. At this stage, the startup has stable business processes, cash flows and easier access to financial and human resources, and the main focus is on expansion. This classification allows us to compare the investments into LCET startups at different stages of their growth when they experience different financing requirements, investment risks, types of active financial actor and availability of capital. Second, we collected data on Indian and global LCET patents using a text-matching algorithm to identify patents belonging to the startups in our dataset. Finally, we conducted 25 interviews to qualitatively analyse the components of the entrepreneurship ecosystem that are associated with the observed trends in LCET startups’ investment and patenting activities.

Investment and patenting trends by sub-sector

As a first step, we consider the trends in investment volume and the number of investment deals segmented by early, late and mature stages (Fig. 1).

The left y axis and the bars depict the total annual investment volume in LCET startups segmented by investment stage. The right y axis and the lines depict the number of investment deals per year in LCET startups segmented by investment stage. To compare with overall investments in the Indian startup ecosystem during the same period, see Supplementary Fig. 1.

Overall, we see a substantial increase in investments in LCET startups over time. Notably, investment activity accelerated after 2015, driven by an increasing number of early-stage investment deals. The compound annual growth rate of the number of deals increased from 14% during 2010–2016 to 25% during 2016–2019. The average annual investment volume during 2010–2016 equalled US$639 million, while that during 2017–2020 equalled US$2,544 million, driven primarily by mature-stage investments.

Figure 2 presents a more detailed analysis of the number of investment deals, average deal sizes and overall investment volumes for each sub-sector; 91.8% of all investments are directed towards startups in the RES sub-sector, of which solar PV technology represents the largest share (92%). The mobility sub-sector receives the second-largest share of investments (7%). All other sub-sectors (grid management, RE-enabled solutions and energy efficiency) received only 1.2% of all investments.

a, Seed to Series D investments. b, Private equity (PE) and exit event investments. Each bar represents investment deals categorized into one funding round and one sub-sector. The width of each bar represents the number of investment deals in that round, and its height represents the average deal size. The whiskers represent the range of the deal sizes—that is, the maximum and minimum values. The number of investment deals in each round is indicated in brackets at the top of each panel. Individual data points are plotted for cases where the number of deals is ten or fewer. Please note that the y axis (Average investment volume per deal) is on a logarithmic scale and that the range of the x axis is chosen to enhance readability.

Although the average size of early-stage investment deals is similar across sub-sectors (seed, series A, series B in Fig. 2a) and all the sub-sectors show some early-stage investment activity, RES and mobility constitute the majority of early-stage investment volumes, representing 88.4% of the total. While global trends39 indicate a similar prominence of investment in the RES sector and increasing importance of the mobility sector, a much smaller proportion of early-stage investments in India are directed towards startups in the energy efficiency sub-sector (5.8%) as compared with global trends (28.2%; Supplementary Fig. 2). For late-stage investments (Series C and D in Fig. 2a), grid management, energy efficiency and RE-enabled solutions attract even fewer investments, both in terms of number of deals and overall investment volume. Finally, RES (dominated by solar PV and wind technology) receives 97.7% of all mature-stage investments (Fig. 2b), followed by mobility with 2.1%.

The patenting trends illustrated in Fig. 3 differ notably from the investment trends. While the small number of granted patents makes it difficult to infer any robust trends over time, there are notable differences in patenting activity between sub-sectors. Overall, 277 patent applications by Indian LCET startups were published between 2010 and 2020, out of which 52.7% belong to startups in the mobility sub-sector, and 18.8% belong to those in the RES sub-sector (Supplementary Fig. 3). Out of this, 48 patents (17.3%) were granted, the majority of which belonged to the mobility sub-sector (27 patents or 56.2% of all granted patents; Fig. 3).

The figure includes both domestic and international patents. Methods provide more details regarding the patent dataset.

This disparity between trends in investment and patenting activity indicates that LCET startups in different sub-sectors might differ in terms of the nature of their core value-creating activity. That is, startups in the RES sub-sector show little patenting activity despite attracting high investment volumes, indicating that they ‘exploit’ existing LCETs by bringing them to the market and benefiting from learning-by-doing40 and economies of scale. In contrast, startups in the mobility sector have a relatively high number of patent applications and granted patents despite attracting relatively lower investment volumes, indicating a greater tendency to ‘explore’ new technological options41. Finally, startups in the energy efficiency, grid management and RE-enabled solutions sub-sectors show some patenting activity, even though there is little investment in these areas. To shed more light on this disparity, we analyse the core value-creating activity of LCET startups in the next section.

Investment and patenting trends by value-creating activity

Figure 4 illustrates the investment trends by core value-creating activity. About 95% of all investments are directed towards startups focusing on LCET deployment. Hardware integration, software solutions and materials and chemicals represent 4.5%, 0.4% and 0.1% of the overall investment volume, respectively.

a, Seed to Series D investments. b, PE and exit event investments. Each bar represents investment deals categorized into one funding round and one sub-sector. The width of each bar represents the number of investment deals in that round and its height represents the average deal size. The whiskers represent the range of the deal sizes—that is, the maximum and minimum values. The number of investment deals in each round is indicated in brackets at the top of each panel. Individual data points are plotted for cases where the number of deals is ten or fewer. Please note that the y axis (Average investment volume per deal) is on a logarithmic scale and that the range of the x axis is chosen to enhance readability.

These differences are slightly less pronounced for early-stage investments, with deployment, hardware integration, software solutions and materials and chemicals accounting for 56.7%, 35.9%, 5.6% and 1.7% of all early-stage investments, respectively. These differences indicate that while many startups have been able to attract early-stage financing, it is less likely to be directed towards LCET startups with relatively high technology risk (that is, those involved in hardware integration, materials and chemicals; Supplementary Figs. 5 and 6) or even towards less capital-intense LCET startups aiming to use software to optimize existing assets (contrary to the observations of Bumpus and Comello19).

Next, we look at the patenting trends segmented by core value-creating activity (Fig. 5). Unsurprisingly, LCET startups involved in hardware integration account for the largest majority, with 214 patent applications (77.2% of all patent applications; Supplementary Fig. 4) and 36 granted patents (75% of all granted patents, of which 69.4% belong to mobility startups). Although 25 patent applications were by startups focusing on LCET deployment, none have been granted. In addition, only 44 patent applications by 24 startups were filed outside India between 2010 and 2020, and nine were granted—indicating that Indian LCET startups predominantly focus on commercializing their innovations in the Indian domestic market.

The figure includes both domestic and international patents. Methods provide more details regarding the patent dataset.

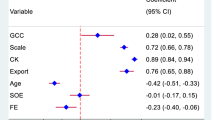

Finally, we summarize the distribution of LCET startups’ fundraising and patenting activity by sub-sector and core value-creating activity in Fig. 6. Figure 6a reveals that investments in the RES and grid management sub-sectors are primarily directed towards deployment. In contrast, a large share of investments into mobility, RE-enabled solutions and energy efficiency sub-sectors are directed towards hardware integration. The patenting trends in Fig. 6b show that patents granted to startups in mobility and RE-enabled solutions are almost exclusively in hardware integration. Thus, in the mobility sub-sector, the greater share of total investments directed towards hardware integration as compared to the RES sub-sector helps explain to some extent why there are more patents in the mobility sub-sector. In contrast, patents in the energy efficiency sub-sector have primarily been granted to startups offering software solutions. Finally, there is notably low patenting activity by startups in the materials and chemicals space. To elaborate on the drivers and barriers associated with investment and patenting activity in different sub-sectors, we present the results of the qualitative analysis in the following section.

a,b, Investment volumes (a) and patents (b) granted to LCET startups from 2010 to 2020, segmented by sub-sector and core value-creating activity. Each bubble represents the intersection of one sub-sector and one core value-creating activity, and the size of the bubble is proportional to the numeric value of the corresponding legend indicator.

Components of the entrepreneurship ecosystem

The trends in LCET startups in India from 2010 to 2020 indicate that there is a substantial increase in the number of investment deals, investment volumes and inventive activity over the period, particularly after 2017. However, there are large differences between different sub-sectors and core value-creating activities. We analyse the interview data to identify components of the Indian LCET entrepreneurship ecosystem42,43,44,45 associated with these trends. The results presented in this section are based on qualitative data collected by interviews (indicated by the interviewee codes ENT for entrepreneurs, INV for investors, and INDEX for industry experts; see Supplementary Tables 6 and 9 for more details), and supported by other studies.

A large share of investments from 2010 to 2020 has been directed towards the deployment of relatively mature renewable energy technologies. Several interviewees noted that this is not surprising, given that in the past decade, India’s ambitious renewable energy deployment targets, strong deployment policies (for example, reverse auctions for solar PV and wind power, net metering for rooftop solar PV)46,47,48 and global reductions in technology costs have contributed to creating a growing market and mitigating investment risks49 (specifically, interviewees represented by interviewee codes ENT11, ENT12 and ENT13 noted this). Thus, venture capital and private equity have played an important role in financing startups focusing on bringing mature renewable energy technologies to the market and scaling up their deployment (Fig. 2). In contrast, startups focusing on the development and manufacturing of materials and chemicals for RES technologies (including still-nascent technologies such as third-generation solar PV cells, biofuels from microalgae) have found it difficult to access resources such as government support for RD&D, human resources, lead customers and early-stage patient capital (ENT1, INV1)50,51. Furthermore, a local manufacturing ecosystem for components for RES technologies has not developed in India, resulting in reliance on imports52. Thus, few LCET startups involved in hardware integration have successfully commercialized their products or achieved scale to become competitive, and concomitantly, an ecosystem for follow-on and exit investments never emerged (Supplementary Fig. 5). These observations are in line with previous studies positing that deployment policies are associated with higher levels of venture capital investments14,15,53 and reduced patenting activity54 and create higher barriers of entry41 and competitive disadvantage55 for less mature technologies.

The mobility sub-sector has received less funding than the RES sub-sector, partly because it is less mature. The earliest major market-creation policy for electric mobility, the FAME Scheme29 (aimed at promoting electric and hybrid vehicle adoption and manufacturing through demand incentives), was announced in 2015, whereas the first major market-creation policy for RES, the National Solar Mission28 (aimed at deploying 20,000 MW of solar power by 2022) was enacted in 2010 (please note that other policies that acted as precursors such as tax benefits and subsidies for RE projects were enacted in the early 1990s and streamlined in the 2000s; Supplementary Table 5 and Supplementary Fig. 7). Although market risks related to a lack of charging infrastructure (ENT5, ENT15), consumer awareness (ENT 2, ENT7, ENT8) and end-consumer financing still need to be addressed, mobility represents India’s fastest-growing and most innovative sub-sector, in line with global trends21,56. Like RESs, global cost reductions in lithium-ion batteries and strong market-creation policies by the government contributed to increasing investments. In particular, the anticipation of the second phase of the FAME scheme in 2019 with a budget of Rs. 10,000 crores (US$1.34 billion) over three years spurred activity in the sector from 2018 (Supplementary Fig. 8). However, the mobility sub-sector followed a different trajectory than RESs, with greater investments into and patenting by startups involved in hardware integration, unlike the RES sub-sector. According to the interviewees, these trends are associated with (1) pre-existing human resources, component suppliers and technological capabilities in vehicle design and manufacturing and (2) patient capital in the form of corporate venture capital and follow-on financing from incumbent two- and three-wheeler manufacturers. Thus, electric two- and three-wheelers accounted for 16.4% and 83%, respectively, of the total 0.76 million electric vehicles sold in 201957. In contrast, startups involved in the manufacturing of materials and chemicals for energy storage technologies used in the mobility sub-sector face similar obstacles as manufacturing startups in the RES sub-sector, such as lack of research, development and demonstration (RD&D) and human resources58 (ENT2, ENT5), weak supply chains (ENT7) and competition with cheaper imports (primarily from China; ENT2)—becoming an adopter of imported technologies (ENT 2, ENT11). These findings are in line with literature on industry catch-up for LCETs that outline the importance of cultivating local technological capabilities for successful industry localization and catch-up by developing countries59,60.

Although grid management, energy efficiency and RE-enabled solutions sub-sectors are relatively mature in terms of technologies and business models, several investment barriers exist. The lack of late- and mature-stage investments in these sectors is indicative of startups being unable to cross the second valley of death61 (in RE-enabled solutions and energy efficiency) and the first valley of death (in grid management). The low investments in grid management and energy efficiency LCET startups are associated with market barriers and long payback periods of eight to ten years arising from subsidized electricity, state monopolies in power transmission and distribution in large parts of the country and a lack of market incentives to optimize the electricity retail and consumption (INV1, ENT9, ENT10)62,63,64. Thus, in the face of such unfavourable risk–return profiles65, the ecosystem for seed capital in these sub-sectors is virtually non-existent. This is in sharp contrast with trends in the United States, where there is an increasing trend towards early-stage equity investments in end-use efficiency and demand control technologies19.

Finally, most startups offering RE-enabled solutions provide off-grid energy services such as irrigation, refrigeration and processing of agricultural produce in rural areas. The low level of investments in this sub-sector is also associated with market barriers and risks arising from low affordability, regulatory uncertainty and fragmented markets, making them reliant on grants and government subsidies. However, the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme66 for incentivizing distributed solar PV for agricultural irrigation has aggregated the distributed market for solar PV-based irrigation and could help catalyse growth in the sub-sector (ENT14). To summarize, the current energy policy framework is not aligned with entrepreneurship objectives in the grid management and RE-enabled solutions sub-sectors.

Discussion and conclusions

Our analysis indicates that although there is increasing activity in India’s LCET ecosystem, it is concentrated in RES and mobility. Investments are primarily directed towards startups focusing on the deployment of relatively mature LCETs in the RES sub-sector and, in recent years, hardware integration and deployment of electric two- and three-wheelers. Patenting activity by LCET startups in India is concentrated in the mobility sub-sector, in contrast to global trends where patenting in grid management and RES sub-sectors is higher than that in the mobility sub-sector (analysis of all LCET patents, that is, not only patents by startups; Supplementary Fig. 9).

Our findings contribute to the growing literature on the role of venture capital in clean energy in two ways. First, Bumpus and Comello19 observed a global trend towards increasing investments in distributed, efficiency and control technologies—a trend that is absent in India. As noted earlier, this is probable because of the highly regulated and subsidized nature of the electricity retail sector. In recent years, India has taken strides to modernize electricity market design and to provide better market signals for power dispatch67. However, more steps in the form of deregulation of electricity retail and introduction of tariff design features such as time-of-use, peak pricing and cost-reflective tariffs will be needed to create markets for demand-side measures for distributed energy resources, energy efficiency and load management62,63,64.

Second, van den Heuvel and Popp21 suggest implementing demand-pull policies for LCETs as a measure to promote clean energy innovation by startups. However, our findings suggest that this might be a necessary but insufficient condition to promote innovation via LCET startups in developing countries such as India, because the level of technological capabilities can moderate the relationship between market-creation measures and startups’ activities and innovation outcomes. Furthermore, our results indicate that in a context with low technological capabilities in a particular sub-sector (such as RESs in India), demand-pull measures are associated with investment flows into deployment-oriented LCET startups. Conversely, in mobility, a sub-sector where some pre-existing technological capabilities exist, demand-pull measures are also associated with hardware integration and patenting activity. Thus, if startups are to be leveraged to promote LCET innovation, market-creation policies will most likely need to be complemented with long-term measures to strengthen technological capabilities (such as measures to improve human capital, increased investment into RD&D and improved linkages between universities, public research and development institutes and entrepreneurs)68. Such measures could be targeted towards sectors where such capabilities are lacking but are closely related to pre-existing knowledge and capabilities in the country to improve their probability of success69,70. Thus, while the government of India has drafted policies to support domestic manufacturing71 in energy storage and solar PV technologies (through the ‘National Program on Advanced Chemistry Cell Battery Storage’72 and the ‘National Program on High-Efficiency Solar PV Modules’73), they will need to be complemented with measures to strengthen the broader entrepreneurship ecosystem (including human capital and supportive activities such as RD&D).

While this study is a first step towards a systematic enquiry into the nature and role of LCET startup activity in India, more work is required to improve our understanding of the role of startups in achieving climate change mitigation goals in India (and other developing countries). Here we lay out a research agenda for understanding LCET entrepreneurship in India that presumably should also be relevant for other developing countries. First, while we have analysed the proximate components of the entrepreneurship ecosystem associated with investment and patenting trends, future research should investigate the broader historical and current institutional, technological, social and economic conditions within which LCET startups are situated and how these conditions influence the rate and direction of evolution of the LCET startup ecosystem, including their sub-sectoral focus and core value-creating activities. Second, more detailed analyses of finance for LCET startups in developing countries are needed. There is some evidence that public and private financiers in industrialized contexts such as the United States and European Union are evolving in response to the specific needs of LCET startups. While our analysis focused on a single case, comparative work analysing how the specific characteristics of domestic and international financial actors and instruments have evolved in developed and developing countries could shed further light on financing conditions that enable or constrain the scope of activities of LCET startups in developing countries. Third, the question of how technological capabilities in different sub-sectors can be strengthened to improve LCET startup outcomes in terms of innovation and growth needs to be better understood. Particularly in a developing country context, such analyses could be valuable in informing public policy measures for capacity building and strengthening climate-relevant entrepreneurship.

Methods

Company and investment data

An investment database was developed to record and analyse the flow of investments into LCET startups in India from 2010 to 2020 (inclusive). Data was primarily collected by performing web-based research. Trusted Indian media sources such as Business Standard, Mint, The Economic Times and The Hindu were referred to track and record investment deals. To ensure comprehensive coverage, we supplemented this database with investment data obtained from market intelligence platforms Tracxn (https://tracxn.com/) and Pitchbook (https://pitchbook.com/). To the best of our knowledge, they represent two of the most comprehensive databases providing information on startups in India. Tracxn, a data and business analytics company, ‘track 1.4 million entities through 1,800 feeds categorized across industries, sectors, sub-sectors and geographies globally.’ Similarly, Pitchbook, a financial data and software company, captures data on the entire life cycle of investment funds (from fundraising to fund liquidation) and private companies (from pre-seed to post-exit). PitchBook has data on ‘3.4 million companies, 1.7 million deals, 406,000 investors and 85,000 funds.’ Both platforms maintain that their research team verifies each data point before accepting it. We identified startups relevant for our study by using the taxonomy provided by both databases, which categorizes startups by industry and sub-industry. For the list of sectors and sub-sectors used to identify the LCET startups, please refer to Supplementary Table 2. We limited our query to startups with their headquarters in India and investment transactions that occurred between and including 1 January 2010 and 31 December 2020. This period was chosen because 2010 represents the beginning of a period of notable activity in India’s LCET startup ecosystem, and 2020 represents the last year for which complete and reliable investment data was available at the time of data collection. Although there was some policy activity related to low-carbon energy technologies before 2010, the announcement of the National Action Plan for Climate Change in 2008 called for the first major market-creation policies for LCETs in the form of national missions related to solar and energy efficiency, which were subsequently launched in 2010. We excluded debt transactions. In addition, we manually verified the data sourced from Tracxn and Pitchbook and added only those startups that fit our selection criteria. Each database entry for an investment deal was checked for reporting errors and was deemed valid only when confirmed by two independent data sources.

Besides collecting data related to investment deals, we also hand labelled each LCET startup based on its sub-sector (RESs, grid management, mobility, energy efficiency and management and renewable energy-enabled solutions) and core value-creating activity (materials and chemical manufacturing, hardware integration, software solutions and Deployment (Supplementary Table 1 provides definitions of each category)). Each LCET startup was classified into one sub-sector and one core value-creating activity based on the information provided on the LCET startup’s website. In case the LCET startup was active in multiple sub-sectors and/or activities, the primary activity was identified based on the most prominent or first category on the website’s homepage or the section describing the company’s products (that is, the section titled ‘Our Products’ or similar) or activities (that is, the section titled ‘About Us’ or similar). Finally, in cases where the LCET startup no longer had an active online presence at the time of our data collection (for example, because of no longer being in business or because of being acquired and assimilated by another firm), we categorized them based on the information in their profile on market intelligence platforms (including Tracxn, Pitchbook and Crunchbase (https://www.crunchbase.com/)).

The database consists of 780 investment deals covering 347 LCET startups between 2010 and 2020, with a total investment volume of US$27.2 billion (2020 dollars). Out of these 780 deals, 80 debt investment deals totalling US$8.2 billion and 29 investment deals of subsidiary companies totalling US$4.4 billion were excluded from our analysis due to the limited availability of data on corporate loans and bonds. Asset finance transactions were also excluded. Among the remaining data points, investment deals were classified as early stage if the financing round was pre-seed, seed, Series A or Series B, which typically correspond to the ideation, prototyping and demonstration phase in the growth of a startup. Any subsequent round starting from Series C up to and excluding PE or an exit event such as an M&A or IPO were classified as late-stage deals. PE, exit events (M&A, IPO) and post-exit equity rounds were designated as mature stage.

We considered investments only in those startups that are domiciled in India and less than eight years old5. Startups domiciled outside India but with operations in India are also omitted. Both public and private sector financial actors and domestically and internationally located investors are considered. Government research and development budget for energy innovation was excluded from the analysis due to the unavailability of data and the lack of clarity on the allocation and use of funds for the support of startups.

Patent data

We used the Indian Patent Advanced Search System (InPASS) provided by the Indian Patent Office (https://ipindiaservices.gov.in/publicsearch/) to extract information about the domestic patenting activity of LCET startups. We collected data on both published and granted patents between and including 1 January 2010 and 31 December 2020 by querying the full name and the stem name (obtained after excluding the common prefixes and suffixes, as elaborated in the National Bureau of Economic Research (NBER) Patent Data Project: https://sites.google.com/site/patentdataproject/Home) of all the startups in our database against the applicants’ names in the search system. The search yielded 233 published patents and 39 granted patents at the Indian Patent Office.

For the data on global patents, we used the World Patent Statistical Database (PATSTAT), offered by the European Patent Office (EPO, see https://www.epo.org/searching-for-patents/business/patstat.html). The database covers more than 100 million patents from 90 patent authorities. We identified and extracted all patents pertaining to LCETs by Indian applicants and inventors using the EPO’s classification scheme for climate change mitigation technologies74 (details of the classification codes used to identify the patents are provided in Supplementary Table 3). The search resulted in 23,243 patent applications, which corresponds to 5,506 patent families, 27,984 inventors and 5,917 unique applicants.

From the combined list of patents obtained from the two sources, we standardized the common prefixes and suffixes75 from applicants’ and inventors’ names and removed duplicate records; we obtained the names of 11,019 unique applicants and inventors. We matched these unique names with standardized names of startups in our database using a fuzzy data matching algorithm. The algorithm utilized the ‘Levenshtein Ratio’ string comparator to compare the names of the startups in our database with the unique names obtained from the two patent databases. We manually reviewed matches with match quality greater than 0.6 by using other information (the applicants’ and inventors’ locations, full patent abstract, company description) to ensure that both companies were the same. Last, we collected information on all patents filed by verified matches between and including 1 January 2010 and 31 December 2020. Supplementary Fig. 10 provides an overview of this process.

We also compared the trends in patenting by Indian LCET startups with global patenting trends for LCET technologies. To do so, we identified and extracted all LCET patents globally from 2010 to 2020 from the EPO PATSTAT database. We used the EPO’s ‘Y02’ classification scheme for climate change mitigation and adaptation technologies to match these patents with the sub-sectors used in our study (details on the mapping between Y02 codes and LCET sub-sectors are provided in Supplementary Table 4). This dataset encompasses 1,044,170 unique patent families (Supplementary Fig. 9).

Policy landscape

We analysed the Indian LCET policy landscape by collecting data on sector-specific policies and schemes announced by the Government of India between 2000 and 2020 (a complete list of policies is provided in Supplementary Table 5). The data were sourced from the Ministry of New and Renewable Energy, India website (https://www.mnre.gov.in) and the International Energy Agency’s policy database (https://www.iea.org/policies).

Expert Interviews

We used qualitative methods to identify the drivers, barriers and enablers in the entrepreneurship ecosystem associated with the observed investment and patenting activity since qualitative methods are better suited for studying the underlying mechanisms of a phenomenon as compared to quantitative methods76. We conducted 25 expert interviews between September 2019 and September 2021 (Supplementary Table 6 provides the full interviewee sample). We followed a stratified purposeful sampling strategy77, stratifying across sub-sectors and core value-creating activities and ensuring representation by entrepreneurs and investors. In practice, we sampled the interviewees in multiple steps. First, we used our dataset on LCET startups to identify investors and entrepreneurs with a prominent role in the Indian LCET entrepreneurship ecosystem in terms of investments and patenting. Second, we reached out to investors and entrepreneurs within our personal networks who are active in the Indian LCET startup space via personal e-mail. Finally, we used snowball sampling77 by asking our interviewees to get us in touch with their contacts with relevant expertise for our study. The interviewees were assured complete anonymity and were assured that none of the quotes used in the study would be directly attributable to them or their companies. The interviews were recorded with the full consent of the interviewees, and the recordings were stored on a secure internal server accessible only to the co-authors of the study. Our final sample comprised 17 entrepreneurs, six investors and two industry experts.

The interviews were conducted in person or over video conferencing by one to four researchers who took individual notes. Each interview lasted 60 to 90 minutes and followed a semi-structured format with two main segments. In the first segment, we showed the interviewees the investment and patenting trends resulting from our quantitative analysis and triangulated them. ‘Triangulation’ is the use of multiple complementary data sources in a mixed-method research design78. In this study, we used qualitative inputs to corroborate, explain, augment and validate the quantitative results. In the second segment, we asked the interviewees about the important drivers, barriers and enablers in the LCET entrepreneurship ecosystem that can help explain the quantitative trends. The interviewees were free to focus on any factor in the entrepreneurship ecosystem that they deemed important. An example interview guide is provided in Supplementary Table 7. The interviews were recorded and transcribed. Transcripts were hand coded, and the identified drivers, barriers and enablers were mapped to the ‘domains of the entrepreneurship ecosystem’42,43 (markets, finance, policy, human capital, culture and supportive activities) to systematically analyse the key components of the entrepreneurship ecosystem associated with the observed trends. Supplementary Table 8 provides definitions and details on the components of these domains, and Supplementary Table 9 provides illustrative quotes from the interviews.

Limitations

Although we endeavoured to be exhaustive in data collection and record all the investment deals falling under the scope of the study, some limitations need to be recognized. There is a possibility of having an incomplete dataset when relying on web-based resources such as media coverage, online public sources and market intelligence platforms. In particular, it is commonly acknowledged that early-stage investments (particularly pre-seed, seed and angel investments) are difficult to capture, as they can often go unreported. Previous studies on startup investments have also noted that there is a possibility of survivorship bias when using secondary data20, that is, information about startups who were active closer to the beginning of our period of analysis (2010) might be underrepresented as compared with startups that were founded closer to the end of the period of analysis (2020). In this study, we mitigated this shortcoming to the greatest extent possible by using multiple data sources to record investment transactions. We also validated the investment trends resulting from our quantitative analysis with our interviewees, who were in agreement with these observations. Finally, we expect these potential biases to be equally valid for different sub-sectors and core value-creating activities, making our comparative observations across startup categories robust to any such potential biases in the data. Nevertheless, to estimate the extent to which we capture information about startups that are no longer active today, for the firms that were active at the beginning of our period of analysis, we estimated the share that were still ‘live’ in 2020 following an approach used by Gaddy et al.18. On the basis of the observation that 80% of startups that either raise additional funding or exit do so within three years of their latest funding round, they categorize companies that have either exited or raised venture capital funding within the last three years as ‘live’ companies. Accordingly, companies that have neither exited nor raised funding in the past three years are categorized as ‘dead’. Using this method, we find that in our dataset, of the 54 startups that were active on 1 January 2010, 22 startups were ‘live’ on 31 December 2020, and the remaining 32 were ‘dead’.

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

The data on investments into LCET startups used in this study were collected through a web-based search and supplemented with data made available to us by Tracxn and Pitchbook under a restricted license and are therefore not publicly available. The patent data were obtained from publicly available sources—namely, the Indian Patent Advanced Search System provided by the Indian Patent Office and the PATSTAT Database provided by the European Patent Office. Supplementary Data 1 contains an anonymized version of our company-level data on investment transactions and patents with the names of the firms removed. The full dataset is available from the authors upon reasonable request and with permission of Tracxn and Pitchbook. Source data are provided with this paper.

Code availability

The code used to match inventor names with standardized names of startups in our database is available from the authors on request.

Change history

08 February 2023

A Correction to this paper has been published: https://doi.org/10.1038/s41560-023-01216-9

References

Mowery, D. C., Nelson, R. R. & Martin, B. R. Technology policy and global warming: Wwhy new policy models are needed (or why putting new wine in old bottles won’t work). Res. Policy 39, 1011–1023 (2010).

Riahi, K. et al. Cost and attainability of meeting stringent climate targets without overshoot. Nat. Clim. Change 11, 1063–1069 (2021).

Held, A. et al. Challenges and appropriate policy portfolios for (almost) mature renewable electricity technologies. Energy Environ. 28, 34–53 (2017).

Energy Technology Perspectives 2020: Special Report on Clean Energy Innovation (International Energy Agency, 2020).

McDougall, P. P., Covin, J. G., Robinson, R. B. Jr & Herron, L. The effects of industry growth and strategic breadth on new venture performance and strategy content. Strategic Manage. J. 15, 537–554 (1994).

Nanda, R., Younge, K. & Fleming, L. in The Changing Frontier: Rethinking Science and Innovation Policy (eds Jaffe, A. B. & Jones, B. F.) Ch. 7 (Univ. of Chicago Press, 2013).

Acs, Z. J. & Audretsch, D. B. Innovation, market structure, and firm size. Rev. Econ. Stat. 69, 567–574 (1987).

Teece, D., Peteraf, M. & Leih, S. Dynamic capabilities and organizational agility: risk, uncertainty, and strategy in the innovation economy. Calif. Manage. Rev. 58, 13–35 (2016).

Technology Executive Committee, Green Climate Fund & Climate Technology Centre and Network Climate Technology Incubators and Accelerators (UNFCCC, 2018).

Global Trends in Renewable Energy Investment 2020 (Frankfurt School-UNEP Centre/BNEF, 2020).

Doblinger, C., Surana, K. & Anadon, L. D. Governments as partners: the role of alliances in US cleantech startup innovation. Res. Policy 48, 1458–1475 (2019).

Goldstein, A., Doblinger, C., Baker, E. & Anadón, L. D. Patenting and business outcomes for cleantech startups funded by the Advanced Research Projects Agency-Energy. Nat. Energy 5, 803–810 (2020).

Doblinger, C., Dowling, M. & Helm, R. An institutional perspective of public policy and network effects in the renewable energy industry: enablers or disablers of entrepreneurial behaviour and innovation? Entrepreneurship Reg. Dev. 28, 126–156 (2016).

Bürer, M. J. & Wüstenhagen, R. Which renewable energy policy is a venture capitalist’s best friend? Empirical evidence from a survey of international cleantech investors. Energy Policy 37, 4997–5006 (2009).

Migendt, M., Polzin, F., Schock, F., Täube, F. A. & von Flotow, P. Beyond venture capital: an exploratory study of the finance–innovation–policy nexus in cleantech. Ind. Corporate Change 26, 973–996 (2017).

Wüstenhagen, R. & Menichetti, E. Strategic choices for renewable energy investment: conceptual framework and opportunities for further research. Energy Policy 40, 1–10 (2012).

Hockerts, K. & Wüstenhagen, R. Greening Goliaths versus emerging Davids—theorizing about the role of incumbents and new entrants in sustainable entrepreneurship. J. Bus. Venturing 25, 481–492 (2010).

Gaddy, B. E., Sivaram, V., Jones, T. B. & Wayman, L. Venture capital and cleantech: the wrong model for energy innovation. Energy Policy 102, 385–395 (2017).

Bumpus, A. & Comello, S. Emerging clean energy technology investment trends. Nat. Clim. Change 7, 382–385 (2017).

Popp, D., Pless, J., Hascic, I. & Johnstone, N. in The Role of Innovation and Entrepreneurship in Economic Growth (eds Andrews, M. J. et al.) Ch. 4 (Univ. Chicago Press, 2020).

van den Heuvel, M. & Popp, D. The Role of Venture Capital and Governments in Clean Energy: Lessons from the First Cleantech Bubble (National Bureau of Economic Research, 2022).

Friedlingstein, P. et al. Global carbon budget 2020. Earth Syst. Sci. Data 12, 3269–3340 (2020).

David, D., Gopalan, S. & Ramachandran, S. in Investment in Startups and Small Business Financing (eds Taghizadeh-Hesary, F. et al.) 193–232 (World Scientific, 2021).

The State of Venture: Q1 2022 Global Report (CBInsights, 2022).

Surana, K., Singh, A. & Sagar, A. D. Strengthening science, technology, and innovation-based incubators to help achieve Sustainable Development Goals: lessons from India. Technol. Forecasting Social Change 157, 120057 (2020).

Mathur, A. K. & Singh, S. Status of India’s Renewable Energy Commitments for the Paris Agreement. In 2019 International Conference on Power Generation Systems and Renewable Energy Technologies (PGSRET) 1–5 (IEEE, 2019).

Zero Emission Vehicles (ZEVs): Towards a Policy Framework (NITI Aayog & World Energy Council, 2018).

Jawaharlal Nehru National Solar Mission: Towards Building Solar India (Ministry of New and Renewable Energy, Government of India, 2010).

Scheme for Faster Adoption and Manufacturing of Electric Vehicles in India (Ministry of Heavy Industry and Public Enterprises, Government of India, 2015).

Probst, B., Touboul, S., Glachant, M. & Dechezleprêtre, A. Global trends in the invention and diffusion of climate change mitigation technologies. Nat. Energy 6, 1077–1086 (2021).

Shrimali, G., Slaski, X., Thurber, M. C. & Zerriffi, H. Improved stoves in India: a study of sustainable business models. Energy Policy 39, 7543–7556 (2011).

Bandi, V., Sahrakorpi, T., Paatero, J. & Lahdelma, R. Touching the invisible: exploring the nexus of energy access, entrepreneurship, and solar homes systems in India. Energy Res. Social Sci. 69, 101767 (2020).

Surie, G. Creating the innovation ecosystem for renewable energy via social entrepreneurship: insights from India. Technol. Forecasting Social Change 121, 184–195 (2017).

Rai, V., Funkhouser, E., Udwin, T. & Livingston, D. Venture capital in clean energy innovation finance: insights from the US market during 2005–2014. Preprint at SSRN https://doi.org/10.2139/ssrn.2676216 (2015).

Moore, B. & Wüstenhagen, R. Innovative and sustainable energy technologies: the role of venture capital. Bus. Strategy Environ. 13, 235–245 (2004).

Marcus, A., Malen, J. & Ellis, S. The promise and pitfalls of venture capital as an asset class for clean energy investment: research questions for organization and natural environment scholars. Organ. Environ. 26, 31–60 (2013).

Surana, K., Doblinger, C., Anadon, L. D. & Hultman, N. Effects of technology complexity on the emergence and evolution of wind industry manufacturing locations along global value chains. Nat. Energy 5, 811–821 (2020).

Malhotra, A. & Schmidt, T. S. Accelerating low-carbon innovation. Joule 4, 2259–2267 (2020).

IEA World Energy Investment 2021 (OECD Publishing, 2021).

Tang, T. Explaining technological change in the US wind industry: energy policies, technological learning, and collaboration. Energy Policy 120, 197–212 (2018).

Hoppmann, J., Peters, M., Schneider, M. & Hoffmann, V. H. The two faces of market support—how deployment policies affect technological exploration and exploitation in the solar photovoltaic industry. Res. Policy 42, 989–1003 (2013).

Isenberg, D. The entrepreneurship ecosystem strategy as a new paradigm for economic policy: Principles for cultivating entrepreneurship. In Institute of International European Affairs. 1–13 (2011).

Fuerlinger, G., Fandl, U. & Funke, T. The role of the state in the entrepreneurship ecosystem: insights from Germany. Triple Helix 2, 3 (2015).

Brown, R. & Mason, C. Looking inside the spiky bits: a critical review and conceptualisation of entrepreneurial ecosystems. Small Bus. Econ. 49, 11–30 (2017).

Spigel, B. The relational organization of entrepreneurial ecosystems. Entrepreneurship Theory Pract. 41, 49–72 (2017).

Altenburg, T. & Engelmeier, T. Boosting solar investment with limited subsidies: rent management and policy learning in India. Energy Policy 59, 866–874 (2013).

Probst, B., Anatolitis, V., Kontoleon, A. & Anadón, L. D. The short-term costs of local content requirements in the Indian solar auctions. Nat. Energy 5, 842–850 (2020).

Surana, K. & Anadon, L. D. Public policy and financial resource mobilization for wind energy in developing countries: a comparison of approaches and outcomes in China and India. Glob. Environ. Change 35, 340–359 (2015).

Shrimali, G., Konda, C. & Farooquee, A. A. Designing renewable energy auctions for India: managing risks to maximize deployment and cost-effectiveness. Renew. Energy 97, 656–670 (2016).

Hayashi, D. Harnessing innovation policy for industrial decarbonization: capabilities and manufacturing in the wind and solar power sectors of China and India. Energy Res. Social Sci. 70, 101644 (2020).

Luthra, S., Kumar, S., Garg, D. & Haleem, A. Barriers to renewable/sustainable energy technologies adoption: Indian perspective. Renew. Sustain. Energy Rev. 41, 762–776 (2015).

Behuria, P. The politics of late development in renewable energy sectors: dependency and contradictory tensions in India’s national solar mission. World Dev. 126, 104726 (2020).

Criscuolo, C. & Menon, C. Environmental policies and risk finance in the green sector: cross-country evidence. Energy Policy 83, 38–56 (2015).

Nemet, G. F. Demand-pull, technology-push, and government-led incentives for non-incremental technical change. Res. Policy 38, 700–709 (2009).

Peters, M., Schneider, M., Griesshaber, T. & Hoffmann, V. H. The impact of technology-push and demand-pull policies on technical change—does the locus of policies matter? Res. Policy 41, 1296–1308 (2012).

State of Climate Tech 2021. Scaling Breakthroughs for Net Zero (PwC, 2021).

Towards eMobility: Putting the Consumer at the Wheel (PwC, 2019).

Kumar, A. R. & Shrimali, G. Battery storage manufacturing in India: a strategic perspective. J. Energy Storage 32, 101817 (2020).

Schmidt, T. S. & Huenteler, J. Anticipating industry localization effects of clean technology deployment policies in developing countries. Glob. Environ. Change 38, 8–20 (2016).

Lema, R., Fu, X. & Rabellotti, R. Green windows of opportunity: latecomer development in the age of transformation toward sustainability. Ind. Corporate Change 29, 1193–1209 (2020).

Karltorp, K. Challenges in mobilising financial resources for renewable energy—the cases of biomass gasification and offshore wind power. Environ. Innovation Societal Transitions 19, 96–110 (2016).

Jadhav, A. M. & Abhyankar, A. R. Emergence of distribution system operator in the Indian power sector and possible way ahead. Energy Policy 160, 112650 (2022).

BNEF Digitalization of Energy Systems (Bloomberg Energy Finance, 2017).

Foster, V. & Witte, S.H. Falling Short: A Global Survey of Electricity Tariff Design Policy Research Working Paper 9174 (World Bank, 2020).

Malhotra, A., Schmidt, T. S., Haelg, L. & Waissbein, O. Scaling up finance for off-grid renewable energy: the role of aggregation and spatial diversification in derisking investments in mini-grids for rural electrification in India. Energy Policy 108, 657–672 (2017).

Poonia, S. et al. Techno-economic evaluation of different agri-voltaic designs for the hot arid ecosystem India. Renew. Energy 184, 149–163 (2022).

Iychettira, K. K. Lessons for renewable integration in developing countries: the importance of cost recovery and distributional justice. Energy Res. Social Sci. 77, 102069 (2021).

Lall, S. Technological capabilities and industrialization. World Dev. 20, 165–186 (1992).

Neffke, F., Henning, M. & Boschma, R. How do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Econ. Geogr. 87, 237–265 (2011).

Hidalgo, C. A., Klinger, B., Barabási, A. L. & Hausmann, R. The product space conditions the development of nations. Science 317, 482–487 (2017).

Fabrizio, K. R., Poczter, S. & Zelner, B. A. Does innovation policy attract international competition? Evidence from energy storage. Res. Policy 46, 1106–1117 (2017).

Production Linked Incentive (PLI) Scheme, ‘National Programme on Advanced Chemistry Cell (ACC) Battery Storage’ for Implementation of Giga-scale ACC Manufacturing Facilities in India (Ministry of Heavy Industry and Public Enterprises, Government of India, 2021).

Production Linked Incentive (PLI) scheme, ‘National Programme on High Efficiency Solar PV Modules’ (Ministry of New and and Renewable Energy, Government of India, 2021).

Veefkind, V., Hurtado-Albir, J., Angelucci, S., Karachalios, K. & Thumm, N. A new EPO classification scheme for climate change mitigation technologies. World Patent Inf. 34, 106–111 (2012).

Akcigit, U., Ates, S. T., Lerner, J., Townsend, R. R. & Zhestkova, Y. Fencing off Silicon Valley: Cross-border Venture Capital and Technology Spillovers (National Bureau of Economic Research, 2020).

Eisenhardt, K. M. & Graebner, M. E. Theory building from cases: opportunities and challenges. Acad. Manage. J. 50, 25–32 (2007).

Palinkas, L. A. et al. Purposeful sampling for qualitative data collection and analysis in mixed method implementation research. Administration Policy Mental Health Mental Health Serv. Res. 42, 533–544 (2015).

Creswell, J.W. in Handbook of Educational Policy (ed. Cizek, G. J.) 455–472 (Academic Press, 1999).

Acknowledgements

This work was supported by funding from Children’s Investment Fund Foundation (A.D.S.), Oak Foundation (grant number OUSA-20-001) (A.M.) and DST-Centre for Policy Research, IIT Delhi (D.D.), and we thank them for their generous support. We gratefully acknowledge the support of our interview partners. We would also like to thank C. Krishna for his valuable feedback on an early draft of this paper.

Author information

Authors and Affiliations

Contributions

A.M. conceived the study. A.M. and Y.K. developed the methodology. H.K. and Y.K. led data collection, with A.M. guiding data collection. H.K. and A.M. led data analysis, with Y.K., D.D. and A.D.S. supporting analysis. A.M. wrote the manuscript, with H.K., Y.K., D.D. and A.D.S. providing feedback and editing. A.M. and A.D.S. administered the project.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks the anonymous reviewers for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Supplementary Information

Supplementary Tables 1–9 and Figs. 1–10.

Supplementary Data 1

Anonymized dataset containing details of all investment deals and patents covered in the study.

Supplementary Data 2

Source data for Supplementary Figs 1–9.

Source data

Source Data Fig. 1

Annual investment into LCET startups from 2010 to 2020 in India segmented by investment stage.

Source Data Fig. 2

Raw data for investment deals by sub-sector.

Source Data Fig. 3

Annual patents granted to LCET startups in India from 2010 to 2020 segmented by sub-sector.

Source Data Fig. 4

Raw data for investment deals by core value-creating activity.

Source Data Fig. 5

Annual patents granted to LCET startups in India from 2010 to 2020 segmented by core value-creating activity.

Source Data Fig. 6

Total investment volumes and patents granted to LCET startups in India from 2010 to 2020 segmented by sub-sector and core value-creating activity.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Krishna, H., Kashyap, Y., Dutt, D. et al. Understanding India’s low-carbon energy technology startup landscape. Nat Energy 8, 94–105 (2023). https://doi.org/10.1038/s41560-022-01170-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1038/s41560-022-01170-y