Investment Bankers Are Now Waging the War on Coal

As UN climate negotiations faltered, bankers on Wall Street brought good news for the climate. What’s even happening?

So let’s say you have one (1) global economy. It currently generates most of its energy by burning carbon-based fuels, which is fine, but then it disposes the resulting carbon-dioxide pollution in the air, wreaking all sorts of general havoc too extensive to recount here, which is not as fine. Naturally you might want to wean your economy off carbon fuels. But how to do it?

For the last quarter century, the world has tried to do it through meetings, lovingly dubbed COPs, or “conferences of the parties.” The parties in question are countries that have ratified the United Nations’ 1994 framework treaty on climate change. Every major UN climate negotiation since then has been a COP: The 2015 Paris Agreement, which encourages countries to decarbonize their economies over time, was finalized at COP21.

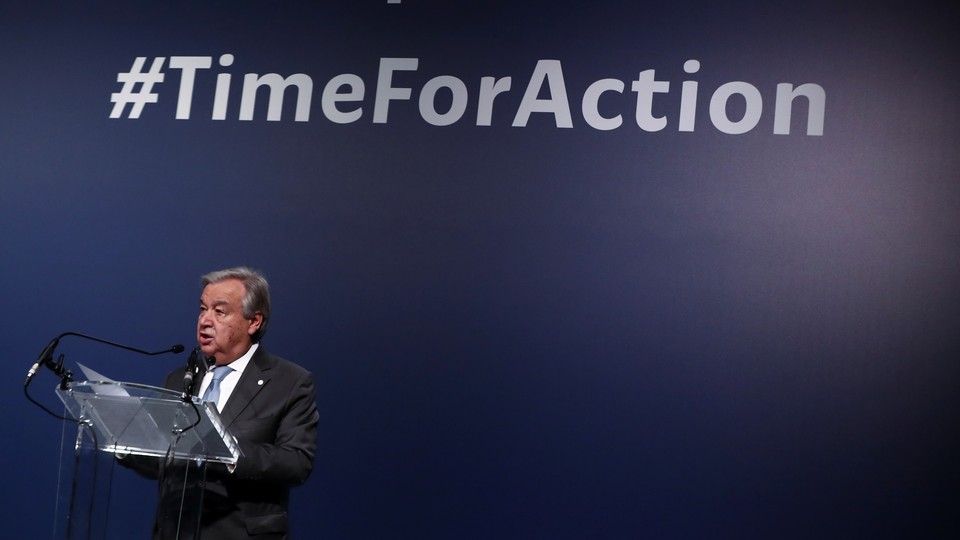

The most recent COP, the 25th, ended on Sunday. It ran two days longer than planned and went, by most accounts, very poorly. “There is no sugarcoating it: The negotiations fell far short of what was expected,” said a vice president of the World Resources Institute, a nonpartisan environmental think tank, in a statement. Corporate Accountability, a progressive advocacy firm, decried the result: “COP25 failed to rise to the challenge of our time.” Even the staid New York Times, in its headline, bemoaned “few commitments and a ‘lost’ opportunity” at the meeting.

What happened? This year, negotiators were supposed to be finishing the “rule book” for the Paris Agreement while preparing for next year’s COP, when countries are supposed to announce more ambitious promises under that treaty. But problems arose on both issues.

First, on the rule book: The Paris Agreement sketches the possibility of trading carbon pollution across borders, and diplomats cannot agree on exactly how to structure it. Some countries—notably Brazil—want to use “banked” credits from the previous international climate regime, the Kyoto Protocol, under the Paris treaty. But most other countries regard this, rightly, as a loophole. (And experts are doubtful that Kyoto’s carbon-trading mechanism really prevented that many emissions: There are rumors of elaborate gamesmanship of its accounting rules.)

Simultaneously, the United States and other big polluters fought off specific terms for “loss and damage” compensation, the amount of money they owe poorer countries who didn’t contribute much to climate change but are now swept up in its whirlwind.

Second, on the ambition: It is not clear that China and India, two of the world’s most carbon-intensive economies, will announce broader climate promises at next year’s COP. These two countries hold the future of the world in their hands. And right now, they are handling that duty by waiting to see if the United States—which remains the world’s largest carbon polluter on a per-person basis—intends to get serious about climate change again. For better or worse, China and India will soon get a giant hint about American intentions: Immediately before the next COP begins, voters will either ratify or reject President Donald Trump’s carbonist stance in the 2020 election.

How bad is all of this? It’s worth separating out two different issues—the relatively arcane question of carbon markets, which I will stop talking about after this paragraph, and the larger direction of climate diplomacy. On the first issue, the Harvard economist Robert Stavins is generally a fan of carbon markets, yet he says that no deal is better than a bad deal: Far better that countries work out good accounting rules privately than be required to honor a globally binding loophole that benefits Brazil. Bentley Allan, a political scientist at Johns Hopkins University who is much more skeptical of carbon markets, agrees with him.

“It’s easy for bad actors to veto this stuff and make everything feel hopeless when there’s no need for that,” he told me. “The narrative that the COP is a failure because they hadn’t agreed to anything under [the carbon-trading rules] is ridiculous.”

Okay, but what about the larger direction of climate diplomacy?

For the most helpful clue, it was best on Sunday not to look to Madrid, where the climate negotiations were wrapping up, but to New York, where a different kind of global governance was unfolding. This weekend, the investment bank Goldman Sachs updated its rules about when and how it would underwrite fossil-fuel projects. Goldman will now refuse to finance oil exploration or drilling in the Arctic, including in the Arctic National Wildlife Refuge in Alaska. It will also decline to finance new thermal coal mines, mountaintop-removal mines, or coal-fired power plants.

Generally, banks both lend capital directly to fossil-fuel companies and connect those companies with third-party investors. Goldman says its ban applies to both kinds of activity. While other banks around the world—including Barclays and Société Générale—have adopted similar policies, Goldman Sachs is both the first American bank and the largest bank by market value to do so.

Goldman also committed to spend $750 billion on a number of clean-energy and climate-adjacent areas over the next 10 years. And David Solomon, the bank’s chief executive, called for countries to put a price on greenhouse-gas emissions in an editorial in the Financial Times.

There’s an understandable tendency to minimize these corporate calls for climate action: Many oil-company CEOs also officially endorse a carbon tax, for instance, even though the oil industry’s trade group fights against it at every opportunity. But Goldman’s actions seem like a much bigger deal. Over the previous decade, about $1 trillion has moved into the clean-energy economy through climate bonds, according to data from the Climate Bonds Initiative analyzed by Allan, the political scientist. While Goldman’s new lending will not take the form of climate bonds, its $750 billion figure will still single-handedly double that level of private funding for climate-mitigation and adaptation over the next decade. As Allan put it: “It’s three-quarters of a trillion dollars. So it’s a lot of money.”

Goldman’s promise not to finance new Arctic oil projects is just as important. For years, student activists have called on schools like Harvard and Yale to divest from fossil-fuel assets, just as universities divested from South African companies during apartheid. (Neither Ivy has yet to do so.) But experts have recognized that divestment from oil-company stocks is the blunt edge of the knife: What will really reshape the economy is divestment from bonds, or corporate debt. The bond market is less liquid and altogether more conservative than the public stock markets. (Just think: It’s possible for you or I to buy a single share of Exxon stock using a smartphone app; buying an Exxon-issued bond is much more challenging.) As the Bloomberg columnist David Fickling has reported, the bond market for some fossil fuels is already drying up: Nearly 80 percent of support for new coal-power projects in Asia comes from governments or state banks.

Now Goldman has also pulled its support for new coal. The bank has its own selfish reasons for this surge in climate spending. Among them: It is trying to move into consumer banking in the United States, and it is especially keen on capturing climate-concerned Millennials for its new online bank, Marcus. It wants to clean a corporate image that, 10 years after the financial crisis, remains tawdry to say the least. And it needs to recruit chipper young undergraduates (often from Harvard and Yale) to join its ranks—and, generally, today’s 20-somethings prefer to avoid complicity in the scorching of the sky. On top of all this, fossil-fuel stocks have systematically underperformed expectations this decade, and financiers are wary of those firms’ business suffering further under future climate policy.

But the bank’s self-interested motivations suggest that it may actually follow through on its stated policy. And the American banks that finance even more fossil-fuel projects than Goldman Sachs—JP Morgan Chase and Wells Fargo lead the list—share many of its concerns and vulnerabilities and, to some degree, touch even more consumers than Goldman does.

That is good news for the planet, probably, but not necessarily for the people who live there. Instead of a planned and rapid transition to a post-carbon economy, the world is now on track for a disorderly and uneven one. Bankers are running a process that policy makers would handle with more care. “Finance is now ahead of the politics,” Allan said. “And when finance is ahead of the politics, then we have a problem with the democratic and political control of the process.”

This state of affairs is especially dire for Americans, as our economy remains tied up in fossil-fuel wealth. So far, the federal government has avoided undertaking the kind of clean-energy industrial policy undertaken by China in this decade and by the European Union in the coming one. If President Donald Trump wins next year, it is unlikely the United States will pursue such a policy until at least 2025, by which time the global supply chain for all manner of green technology—from batteries to electric cars—will be essentially locked up.

And what of international climate diplomacy? Funny enough, there is already a climate treaty well suited to the herky-jerky decarbonization now happening around the world. It’s called the Paris Agreement. “The virtue of Paris is experimentalism and voluntarism,” Allan told me. “Paris is an admission that we can’t get the [UN] process ahead of the politics and economics of it. And the rapid progress on the politics and economics over the last 12 months shouldn’t be washed out just because the COP didn’t pan out.”

In other words, unlike the Kyoto Protocol—which deployed exactly the kind of cross-border carbon rules that flummoxed this year’s COP—the Paris Agreement said countries should just start decarbonizing, and try to get better at it over time. Not every COP will be productive or even inspiring, but over time, as capital changes hands and technologies improve and the public demands it, the global economy will move away from carbon.

Or at least that’s the hypothesis. Next year’s COP—and next year’s American election—will continue to test it. And there are some experiments that climate advocates would prefer not to run.